In Spain, self-employed individuals have historically borne the weight of a complex and challenging social security system. Now, as Spain embarks on a journey of reform, it becomes imperative to dissect these changes carefully. While these reforms are often presented as a step forward, they also cast a shadow of apprehension, particularly for the self-employed. In this examination, we’ll endeavor to delve deeper into the intricacies of this new scheme, aiming to gain a comprehensive understanding of its potential implications.

How does it work?

Starting now, sole traders’ fees will be calculated based on their total turnover from all economic activities. While it may initially appear fairer, the reality may differ from the initial impression.

How Is Turnover Calculated?

Calculating turnover is a straightforward process:

- Begin by determining the profit of your business for the year, which is your income minus expenses.

- Take this annual profit figure and add the autónomo fee.

- Next, divide this sum by 12 months to arrive at your monthly profit.

- Here comes a beneficial twist: Social Security allows a deduction of 7% (or 3% for autónomos with a company) from the aforementioned figure.

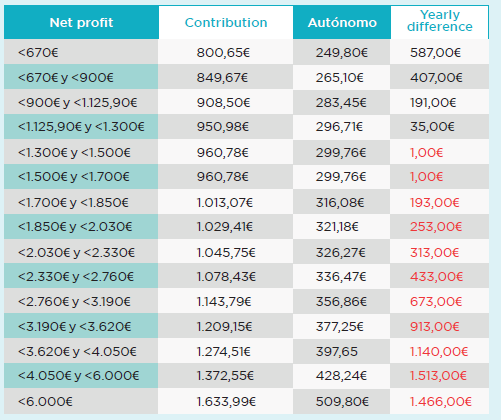

- The remaining monthly profit is what you’ll allocate according to the table below:

What happends if this figure changes during the year?

You have the option to change the fee 6 times per year:

- Between 01/01 to 28/02. The change will be on 01/03.

- Between 01/03 to 30/05. The change will be on 01/05.

- Between 01/05 to 30/06. The change will be on 01/07.

- Between 01/07 to 31/08. The change will be on 01/09.

- Between 01/09 to 31/10. The change will be on 01/11.

- Between 01/11 to 31/12. The change will be on 01/01 of the next year.

At the end of the year, it should be calculated again how much you paid and how

much you should have paid. We can have different scenarios:

- You paid more that you have to. Social Security will pay you back the amount in 4 month unless you want to contribute more.

- You paid less that you have to. Social Security will give you 2 months to pay the outstanding amount. The payment of this fee will be accounted and deductible on the year you pay it.

- You paid exactly what you have to. Nothing to do.

Which percentage do you pay as autonomo?

In 2023, it is the 31,20% of the base.

Is still applicable the bonification for new autonomos?

Yes. Now it is 80 € per month during the first year. There is an extension of another

year as long as your income is less than the minimum salary.

Not an easy one, right? Don’t worry, I can help you to deal with all of this easily.